A new trend is brewing in the craft beer world, and it’s one without a buzz.

Traditionally castigated to out-of-sight coolers and the bottom of beer lists, craft brewers are stepping into the realm of non-alcoholic brews and experimenting with the wide variety of flavors and styles consumers are accustomed to seeing in their alcohol-containing counterparts. It’s a change standing to represent a potentially significant shift in how brewers, and the larger beer industry, conceive of both beer and beer consumers.

“No one focused on flavorful non-alcoholic beer targeted toward the craft beer consumer, so people didn’t know it was an option,” said Chris Lohring, owner and head brewer of Notch Brewing in Salem, which started brewing non-alcoholic beers just before the coronavirus pandemic.

The reasons a person may choose to drink craft non-alcoholic beer instead of standard craft beer options are as varied as the reasons a person might abstain from alcohol, whether for health, lifestyle, religious, or cultural reasons – some temporary, some permanent.

Shifting waters

For Notch, which has long specialized in session beers – beers with lower alcohol content – Lohring said making the leap to brew non-alcoholic options was a logical step. While the larger craft beer industry leans toward higher-alcohol content products, where it’s typical to see craft brews coming in at 6%, 7%, 8% alcohol by volume or higher, Lohring opted to specialize in lower ABV beers at Notch because he’s always personally drifted toward them.

From his vantage point, the thinking that intensity of beer flavor and high alcohol content have to go hand in hand is a blindspot, a viewpoint he described as very American.

Notch is making small batches of non-alcoholic pilsner and a New England IPA, which will initially be distributed around Massachusetts, with plans to scale up.

Customer response, he said, has been great.

“People are thrilled,” Lohring said.

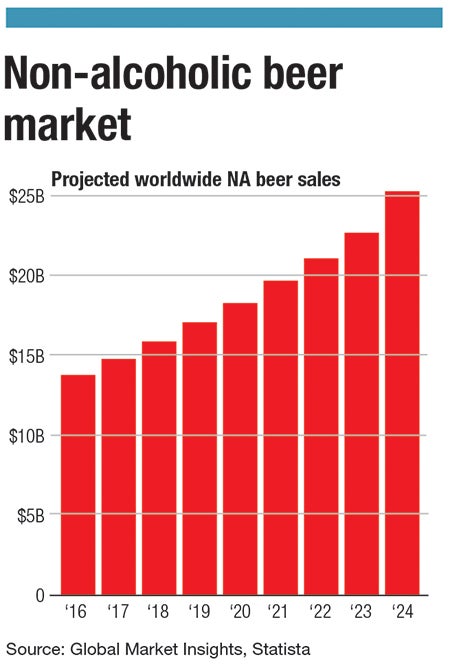

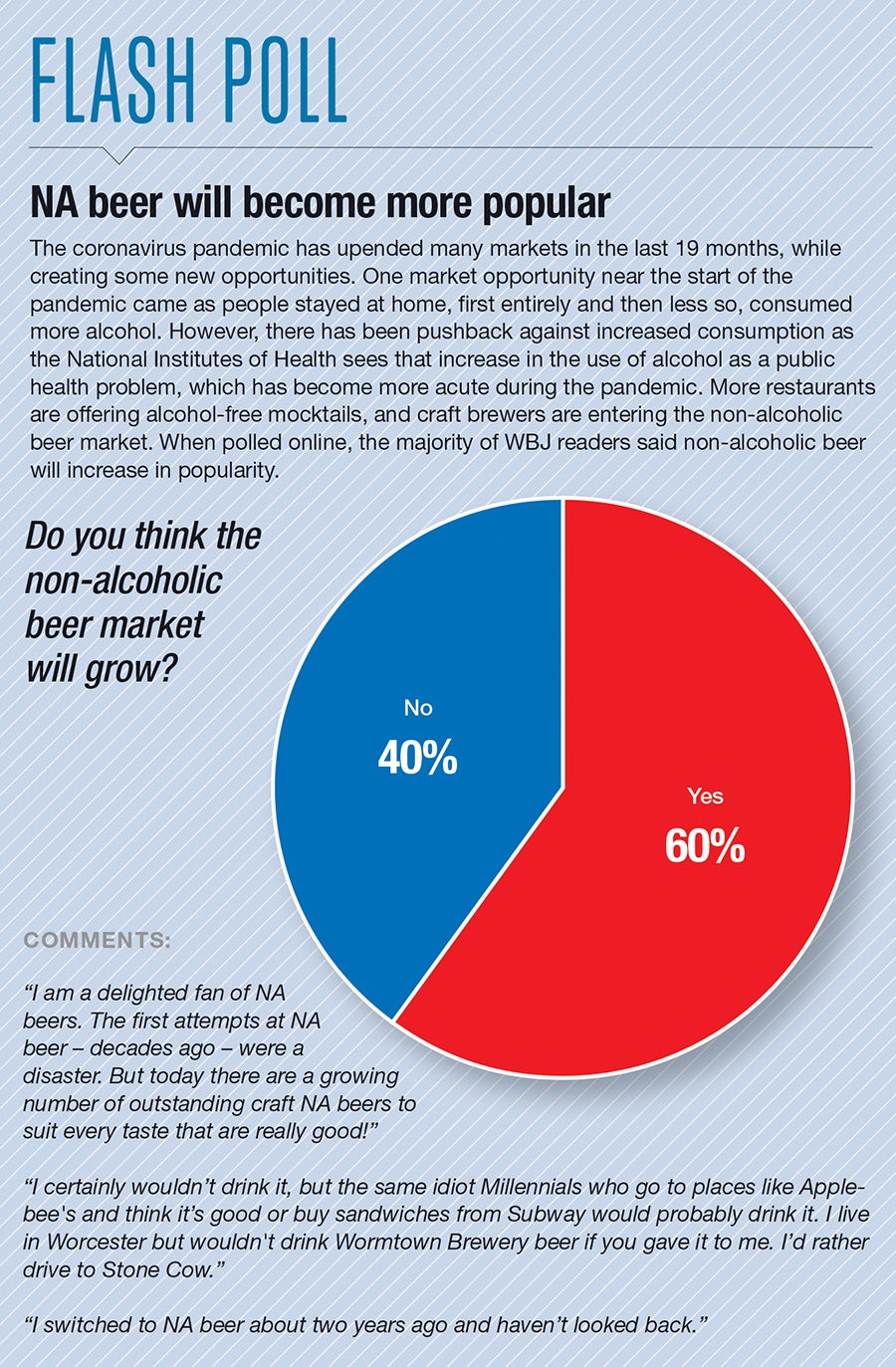

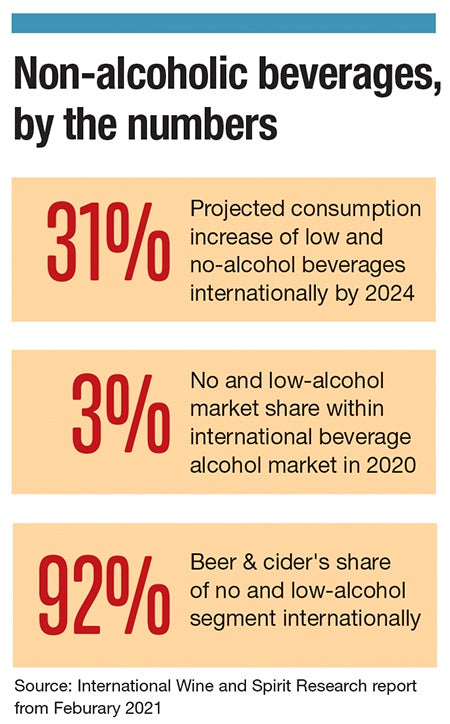

Although the overall market share of low and non-alcoholic beer within the alcohol beverage market is small – coming in at about 3% worldwide, per International Wine and Spirit Research, which tracks these figures, consumption of these products is projected to increase by nearly a third by 2024.

“The sales numbers seem to bear out there is a rise in popularity,” said Sam Hendler, president of Mass Brewers Guild and co-founder of Jack’s Abby Craft Lagers in Framingham.

He pointed to broader cultural health trends, including the ongoing seltzer craze, which appeals to a lot of health-conscious consumers looking for lower-calorie drink options. The prevalence of so-called Dry Januarys and Sober Octobers, wherein people who drink alcohol choose to temporarily abstain, generally as a reset before or after heavier-than-average drinking periods, feeds into these trends as well.

Craft brewers have a chance to step into a new market space if they take advantage of their positioning and work on engaging consumers, he said.

Brewing NA beer

Within his own business, Jack’s Abby is in the trial phase for making its own non-alcoholic beer, Hendler said, as the company is focused on process.

“There are a lot of different ways to produce non-alcoholic beer, but all of them come with significant challenges for a craft brewer,” Hendler said. “It’s a very different process from producing our typical beer.”

The safety concerns, while not necessarily more time consuming than producing standard alcoholic brews, he said, are very different. There are differences in stability concerns with non-alcoholic beers, for example, and there are certain spoiling organisms which don’t pose an issue in traditional beers.

This has made it challenging for local craft brewers, especially smaller ones, to start brewing non-alcoholic options of their own.

“Most breweries in Massachusetts are on the smaller scale and just being able to commit that tank space to a non-alcoholic beer … to take up a tank space and put NA beer we know will sell, but will probably take longer to move, it doesn’t really make sense for a smaller brewery in my opinion,” said Melynda Gallagher, co-owner of Lost Shoe Brewing & Roasting Co. in Marlborough.

That doesn’t mean these smaller brewers are out of the game, entirely. Lost Shoe retails non-alcoholic beer made by Athletic Brewing Co., headquartered in Stratford, Conn. Athletic is one of the rising stars in the non-alcoholic beer world right now, and selling its products allows Lost Shoe to both cater to consumer demand and sell a beer still made in New England.

Lost Shoe added Athletic brews to its menu about three months ago, she said, after Lost Shoe’s bartenders reported an uptick in requests for non-alcoholic options.

“It’s been a nice addition to our menu, and I do think people appreciate having that non-alcoholic beer option when they’re just not in the mood to drink,” Gallagher said.

Non-alcoholic beers are particularly fitting for Lost Shoe because the brewery is also a coffee roastery, meaning it already served non-alcoholic beverages to begin with. Having non-alcoholic beers just adds another attraction to its offerings.

Hendler, from Jack’s Abby, said it’s hard to say why some consumers are backing away from higher-alcohol products and drifting toward lower or no-alcohol alternatives, but the shift is trending, including in Central Massachusetts. With the pandemic, markets were turned upside down, making it even more difficult to say exactly why the shift is happening.

“It’s going to be a really interesting challenge for brewers to get into this space,” Hendler said. “It is a very very different process than producing typical beers. It has a very different set of concerns. I’m excited to see what craft brewers can do with it.”